Understanding Prop Trading Companies: The Future of Financial Services

In today's dynamic financial landscape, the role of prop trading companies has grown exceptionally crucial. These firms, which trade on behalf of their own capital rather than clients', are not just financial players; they are vibrant entities that drive market liquidity and innovation. In this comprehensive article, we will delve deep into what prop trading companies are, how they function, and their influence on the broader financial ecosystem.

What is a Prop Trading Company?

A prop trading company (short for proprietary trading) is a financial firm that trades stocks, bonds, currencies, derivatives, and other financial instruments using its own capital, aiming for profit. This differs significantly from conventional trading companies that operate on behalf of clients. The primary goal of a prop trading firm is to capitalize on market inefficiencies and price movements to generate returns.

Key Characteristics of Prop Trading Firms

- Self-Financing: Prop trading companies leverage their own funds to execute trades, thereby assuming full risk of their trading strategies.

- High Risk, High Reward: The potential for substantial profits comes with significant risk, making the trading strategies employed by these firms critical to their success.

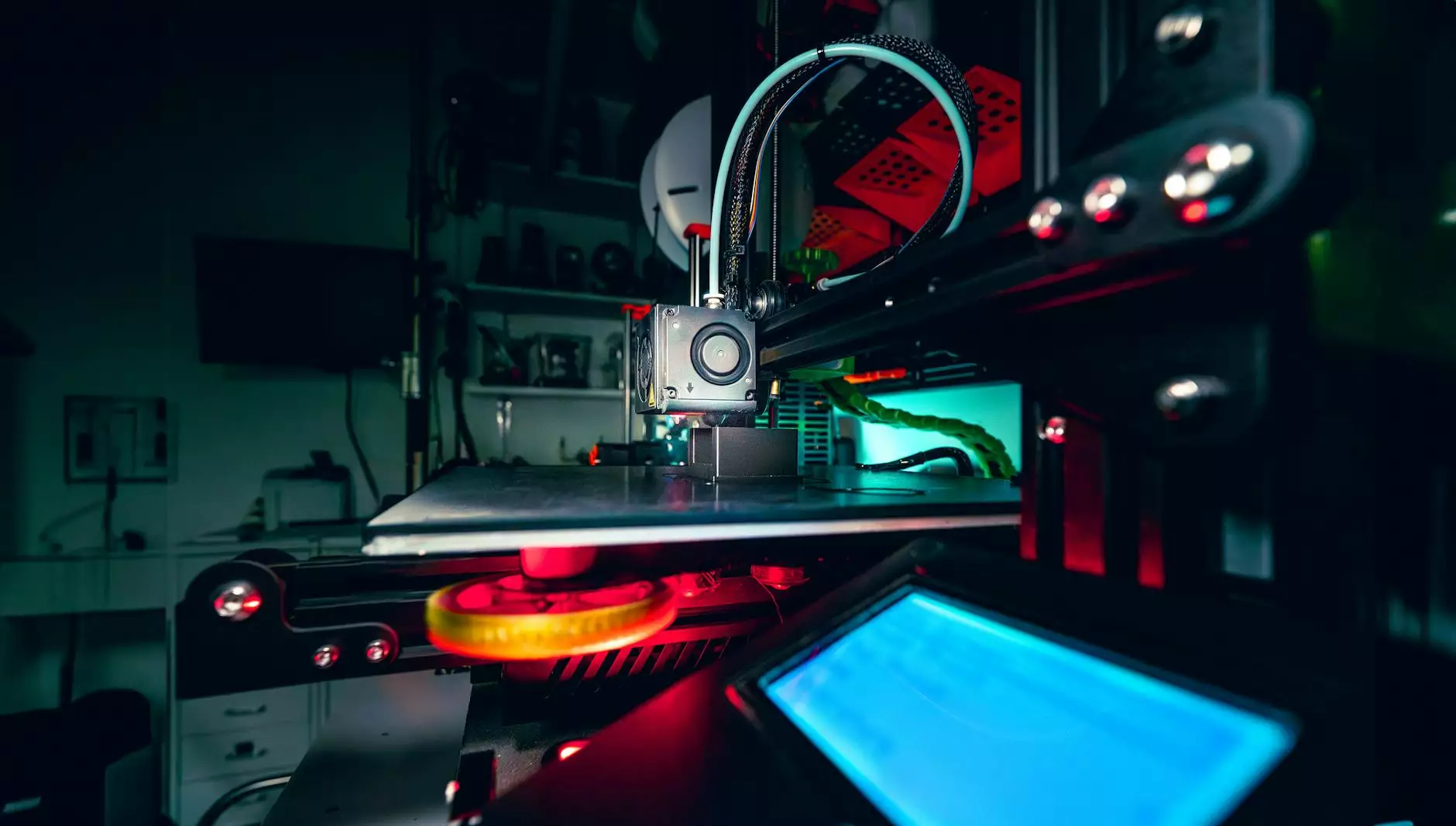

- Advanced Technology: Many prop trading companies invest heavily in state-of-the-art technology and algorithms to enhance their trading efficiency and market analysis.

- Trained Traders: Typically, these firms employ top-tier traders who possess advanced analytical skills and a deep understanding of market mechanics.

- Liquidity Provision: By trading large volumes, prop firms contribute to market liquidity, which is essential for efficient price discovery.

The Operational Mechanics of Prop Trading

Understanding how a prop trading company operates requires insight into its core functions and strategies. These firms generally engage in a variety of trading activities:

1. Market Making

Prop trading firms often act as market makers, providing liquidity by standing ready to buy and sell securities at all times. Market makers play a vital role in ensuring that there is enough stock available for trading, thereby facilitating smoother transactions in the financial markets.

2. Arbitrage Opportunities

Arbitrage involves taking advantage of price discrepancies between markets. Prop traders often exploit these differences. For example, if a stock is priced lower on one exchange than on another, a prop trading firm may buy the asset on the cheaper exchange and sell it on the more expensive one, thereby locking in a profit.

3. Trend Following and Momentum Trading

Another popular strategy among prop trading companies is trend following. Traders analyze market trends and momentum patterns. If they identify a strong upward or downward movement, they may employ strategies to profit from these trends until they begin to show signs of reversing.

The Role of Technology in Prop Trading

The integration of technology into prop trading companies cannot be overstated. These firms utilize sophisticated trading platforms and algorithms that perform complex calculations in milliseconds. The functionalities of these technologies include:

- Algorithmic Trading: Algorithms enable traders to execute trades at optimal prices based on pre-defined criteria and market conditions.

- High-Frequency Trading (HFT): This involves executing a large number of orders at extremely high speeds, allowing firms to capitalize on tiny price gaps that last for only a fraction of a second.

- Data Analytics: Advanced analytics tools help traders interpret vast amounts of data, identifying patterns and trends crucial for making informed trading decisions.

- Risk Management Software: Prop trading firms often use proprietary or third-party risk management systems to analyze and mitigate potential losses.

The Impact of Prop Trading on Financial Markets

Prop trading companies significantly influence financial markets. Their activities can lead to both positive and negative impacts:

Positive Impacts

- Enhanced Liquidity: Increased trading activity from prop firms can enhance market liquidity, reducing the cost of trading for all market participants.

- Efficient Price Discovery: By placing trades based on sophisticated analyses, prop traders help ensure that asset prices reflect all available information.

- Market Stabilization: During periods of volatility, the trading activities of prop firms may help to stabilize prices, alleviating extreme fluctuations.

Negative Impacts

- Market Manipulation: In some cases, aggressive trading strategies may lead to price manipulation, which can adversely affect market integrity.

- High Volatility: The rapid trading practices of certain prop trading firms can exacerbate market volatility, particularly in times of uncertainty.

Becoming a Part of a Prop Trading Company

If you are considering joining the ranks of a prop trading company, there are several pathways and qualifications worth considering:

1. Education and Qualifications

While formal education is not always mandatory, possessing a degree in finance, economics, mathematics, or a related field can provide a solid foundation. Additionally, having certifications such as the Chartered Financial Analyst (CFA) can enhance your credibility.

2. Skills Development

A successful prop trader must possess strong analytical skills, a deep understanding of market dynamics, and a knack for making rapid decisions under pressure. Joining trading competitions or internships can provide hands-on experience.

3. Joining a Prop Trading Firm

Many prop trading firms offer training programs. These programs provide aspiring traders with the tools and knowledge necessary to thrive in a competitive environment. Some popular firms include:

- Jane Street: Known for its quantitative trading approach.

- DRW Trading: Offers a wide range of trading strategies across markets.

- Optiver: A global technology-driven trading firm that focuses on electronic trading.

The Future of Prop Trading Companies

The future of prop trading companies is promising, marked by continued innovation and adaptation. With the evolution of markets and technology, these firms are likely to embrace new opportunities and face challenges, including:

1. Regulatory Changes

Increased scrutiny of financial markets means that prop trading firms must navigate an evolving regulatory landscape. Adapting to compliance requirements will be crucial for long-term viability.

2. Integration of Artificial Intelligence

As artificial intelligence (AI) and machine learning technologies continue to advance, many prop trading firms are integrating these tools to enhance predictive analytics and trading strategies.

3. Cryptocurrency Trading

With the rise of cryptocurrencies, prop trading companies are beginning to explore opportunities in this emerging asset class, looking to capitalize on its high volatility and potential for profit.

Conclusion

In conclusion, prop trading companies play an essential role in the financial industry, providing liquidity and facilitating trades that contribute to market efficiency. As technology continues to evolve and the financial landscape shifts, these firms will need to adapt, innovate, and adhere to regulatory demands. For aspiring traders, understanding the intricacies of prop trading and the skills required to succeed can lead to a rewarding career in one of the most dynamic sectors of finance.

By harnessing the power of strong analytical skills, a deep understanding of market mechanisms, and the right technological tools, both individuals and firms can seize the opportunities presented by this exciting space in the financial world.